Last updated on August 29th, 2023 at 02:45 pm

This article shows you to invest in treasury bills in Kenya.

Investing in treasury bills is a smart financial move for anyone who wants to earn a low-risk return on investment. Treasury bills are sold by the Kenyan government through Central Bank of Kenya (CBK) and offer a low-risk investment opportunity with a guaranteed return. If you’re interested in investing in treasury bills in Kenya, this guide will help you get started.

What are Treasury Bills?

Treasury bills are short-term debt securities issued by the Central Bank of Kenya on behalf of the government. They are typically issued in denominations of KES 1000, KES 5000, KES 10,000, KES 50,000, KES 100,000, and KES 200,000.

Treasury bills are issued for a period of 91, 182, and 364 days with varying interest rates. They are considered to be one of the safest investment options because they are backed by the government and have a low risk of default.

How to Invest in Treasury Bills in Kenya

To invest in treasury bills in Kenya, you need to have a Central Depository System (CDS) account. This account is like a bank account for your shares and securities. It allows you to buy and sell securities such as treasury bills, bonds, and shares.

To open a CDS account, you need to visit a stockbroker or investment bank that is registered with the Nairobi Securities Exchange (NSE). You will need to provide your identification documents and fill out an account opening form.

Step 1. Open a CDS Account

Requirements for Individuals Opening CDS Accounts

- Individuals may hold a single or joint CDS account but NO minor accounts.

- Each individual CDS account holder/applicant MUST complete the CDS accounts specimen signature mandate card (the card) which can be collected from any of the Central Bank of Kenya Branches in Nairobi, Mombasa, Kisumu, Eldoret or the Currency Centres in Meru, Nakuru and Nyeri.

- The card(s) should be completed in BLOCK LETTERS, neatly and clearly.

- Names MUST be written in the order that they appear on the identification document.

- NO alternations/errors.

- The card MUST not be folded or disfigured in anyway.

- Signatories to the CDS account will be required to sign the card in the presence of a designated CBK Officer or any Authorized Agent.

- On completion applicants will personally submit the duly completed card(s) together with:

- o One recent coloured passport size photograph of the account holder.

- o The reverse side of the photograph MUST be certified by the applicants Bankers and stamped.

- o The photograph must NOT be stapled or glued to the card.

- o The original and clear copy of the National Identity Card/valid passport/alien certificate for verification. (Note that the copies will be retained by CBK.)

- Two signatories of your Bankers, whether a commercial bank or financial institution must sign and stamp the card on the space provided, confirming the bank account details.

Other requirements

- The commercial bank/financial institution under Note 9 above must be licensed by the Central Bank of Kenya.

- Payments will be made to the Bank account specified in the mandate card.

- On receipt of all the requirements, CDS account application(s) will be processed within seven working days.

- Change of address may be advised through a letter signed by signatories as per the mandate.

- To change details of the CDS account one completes a CDS card and follows all the requirements mentioned from No. 1 to 9.

For any further clarifications kindly:

Contacts: +254 20 2860000

Email: [email protected] or [email protected]

Office location: Nairobi, Kisumu, Mombasa, Meru, Nakuru or Nyeri.

After opening a CDS account, you can proceed to invest in treasury bills by following these simple steps:

Step 2: Check the Treasury Bills Auction Calendar

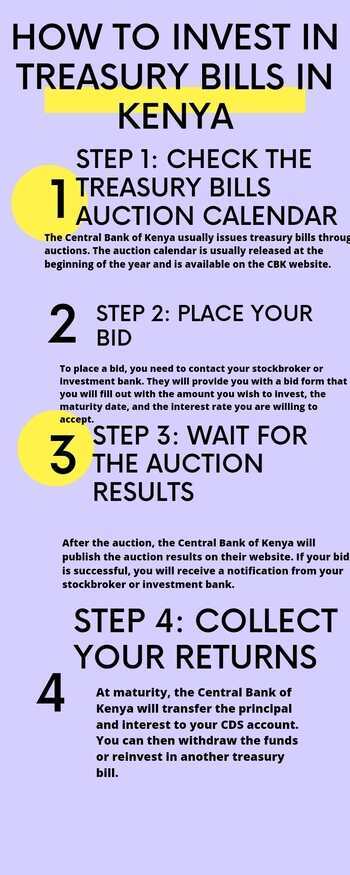

The Central Bank of Kenya usually issues treasury bills through auctions. The auction calendar is usually released at the beginning of the year and is available on the CBK website.

Also Checkout: How to earn 3k daily in Kenya

The auction calendar indicates the dates when the treasury bills will be auctioned, the amount on offer, and the minimum investment amount. It is important to check the auction calendar to determine the right time to invest in treasury bills.

Step 2: Place Your Bid

To place a bid, you need to contact your stockbroker or investment bank. They will provide you with a bid form that you will fill out with the amount you wish to invest, the maturity date, and the interest rate you are willing to accept.

The minimum investment amount for treasury bills is KES 100,000. However, you can invest in multiples of KES 50,000.

Step 3: Wait for the Auction Results

After the auction, the Central Bank of Kenya will publish the auction results on their website. If your bid is successful, you will receive a notification from your stockbroker or investment bank.

You will then be required to transfer the funds to your CDS account. The funds will be held in your CDS account until maturity.

Also Checkout: Investing in government bonds in Kenya

Step 4: Collect Your Returns

At maturity, the Central Bank of Kenya will transfer the principal and interest to your CDS account. You can then withdraw the funds or reinvest in another treasury bill.

Conclusion

Investing in treasury bills in Kenya is a simple and straightforward process. With a minimum investment of KES 100,000, you can earn guaranteed returns with low risk. Remember to check the auction calendar, place your bid, wait for the auction results, and collect your returns at maturity.