Mpawa Insurance is an insurance agency that is fully owned by Stima DT Sacco Society Limited. It’s licensed under the Insurance Act and offers various classes of insurance, including life and non-life insurance, as well as medical products. Additionally, the agency provides claim and risk management services to both its members and non-members.

Which insurance products does Mpawa deal with?

Mpawa deals with all classes of insurance, including Motor, Medical, Domestic Package, fire, etc.

1. Mpawa auto insurance

Mpawa auto insurance policy protects the insured against financial loss if the motor vehicle is involved in an accident, burned, or stolen. The cover is for accidental damage or loss to the motor vehicle and its accessories.

Features

- Comprehensive coverage

- Loss of use for 14 days (Courtesy Car)

- Towing Limit of Kes 50,000.00

- Authorized Repair Limit of Kes 50,000.00

- Windscreen Limit of Kes 50,000.00

- Radio cassette of Kes 50,000.00

- Emergency Medical of Kes 50,000.00

- Personal Accident for Insured/Authorized Driver of Kes 250,000.00

- Cost of alternative accommodation of Kes 10,000.00

- Loss of Keys following an accident of Kes 15,000.00

- Passenger legal liability: Any one passenger of Kes 5 million, per event of Kes 20 million.

- Own Damage Excess Protector

- Geographical Area: East Africa

- Political Violence, Riots, strikes, and Terrorism are covered

2. Mpawa Afya Health Cover

MPAWA AFYA Health provides comprehensive and affordable medical coverage for individuals, families, businesses, groups, and institutions. The cover comprises inpatient, outpatient, dental, and optical benefits. It comes with an inbuilt maternity cover and last-minute expense cover.

Plan Summary

1. All inpatient treatment is subject to preauthorization

2. All benefits are subject to overall annual benefit unless specified otherwise.

3. The scope of maternity cover includes the following services:

- Inpatient cost incurred for normal and caesarean deliveries.

- Labor and recovery wards

- Professional fees

- Pregnancy- and maternity-related hospitalizations

- Other related ailments and complications, including ectopic pregnancies and miscarriages

4. The last expense cover will be payable within 48 hours of confirmation of death of a member. This is covered within the inpatient limit.

Eligibility

1. Employees actively in service between the ages of 18 and 75 are eligible for the coverage.

2. A member already in the scheme can have the cover extended up to 80 years of age if he or she remains in active service and has a satisfactory detailed medical

report.

3. Dependent children are eligible for cover from 0 months (a term baby of 38 weeks) up to the age of 18 years or to the age of 26 years if residing with their

parents and enrolled full-time in a recognized post-secondary institution.

Waiting Period

The standard waiting period is:

1. 30 days for all claims (including outpatient), except accidents and medical emergencies.

2. 60 days for surgical cases, except for accidental injuries incurred within the period of cover.

3. 10 months for maternity and related conditions.

4. All other waiting periods are as per the benefit schedule.

How to apply for MPAWA AFYA health insurance coverage

1. Complete and sign the Mpawa Afya health insurance application form

2. Attach

- ID and PIN copies of all adult applicants, dependents, and beneficiary.

- Birth Certificate/birth notification copies for all child dependents (under 18 years).

- Passport size-colored photographs of each applicant.

3. Submit the fully completed and signed application form and supporting documents to the nearest Stima Sacco Branch.

3. COVID 19 Benefit Policy

1. Covid 19 benefit policy offers 100% lumpsum payment on diagnosis and hospitalization of COVID-19

2. The cover is limited to Kenyan residents staying in Kenya during the period of cover who are between the ages of 1 and 70

3. The Insured must have contracted Covid-19 and hospitalized for at least 24 hours in an accredited medical facility for the policy benefit to be paid

4. The Insured must not have any pre-existing Respiratory Medical condition

5. There is a mandatory waiting period of 16 days after inception of the Covid-19 cover

Frequently Asked Question about COVID-19 Benefit Cover

1. What is covered under the policy, and how can I purchase my coverage?

COVID-19 Insurance Policy provides Coverage for a person on diagnosis andhospitalization with COVID-19 for at least for 24 hours

2. Will I be covered if I travel outside Kenya?

No. Payment under this policy shall not be made if the insured person travels outside Kenya during the period of cover or has travel history 60 days before the inception of the cover.

3. If I have pre-existing health conditions, will I be covered?

The cover does not cover any illness, sickness, or disease other than COVID-19. People with pre-existing respiratory conditions are excluded from coverage; hence, they should not purchase this product.

4. What are the documents required for the claim?

- Claim Form duly completed and signed

- A diagnostic test confirming COVID 19 from a

- government-authorized center.

- Copy of ID Card and passport

- Hospital Admission form

5. Why should I have to wait 16 days before my policy is effective?

This is to avoid fraudulent cases whereby people will purchase the product after realizing they are already infected with COVID-19.

6. Does the policy cover both asymptomatic and symptomatic confirmed cases?

No. The benefit policy is to assist those of us who have been adversely affected. Therefore, a positive test and hospitalization of at least 24 hours are required for the policy to pay.

7. If I have been recommended for home-based care, does my policy cover that?

No, it does not. Hospitalization for at least 24 hours is a must for the policy to pay.

4. Mpawa Last Expense Funeral Policy

This policy pays defined benefits in the event of a member’s death during the period of insurance. Benefits are paid within 48 hours of submission of claim documents Cover is 24 hours worldwide.

Waiting period

1. Principal member; Spouse and Children: I month

2. Parents and Parents-in-Law: 3 Months

3. There is no waiting period for accidental deaths.

Age limits

1. Member and spouse minimum age at entry is18 years and maximum age at entry is 70 years

2. Parents and parents-in-law minimum age at entry is 30 years, and maximum age at entry is 84 years.

3. Children’s minimum age at entry is 1 month, and their maximum age at entry is 21 years. This can be extended up to 25 years with proof of being in full-time education.

Claim documents

1. Claim notification form

2. Copy of Principal ID or passport

3. Copy of Deceased ID or Passport

4. Copy of the Burial Permit

5. Mpawa Household Insurance Policy

This is a combined policy for homeowners. It covers the building itself, contents in the house and outside the house, house servants against death or injury while in the course of employment, and personal legal liability to third parties. Policy can be extended to cover political risks and terrorism.

Sections

• Section A: Value of Buildings: Rate of 0.1%

• Section B: Value of Household Contents: 0.5%

• Section C: Value of All Risks Items (Movable Items such as mobile phones,

watches, etc.) at a rate of 1.75% for mobile phones and others at 1%.

• Section D-WIBA (Workers): 1 Indoor servant free, 1 Outdoor servant free

charge and Kes 1,000.00 for others.

• Section E: Owner’s liability: $5 million free

• Section F: Occupier’s Liability 5 million free

• Section G: Personal Liability-5,000,000/- (5,000,000)

• Excess: Section B and C-10% of Loss Minimum 2,500/-

Minimum Premium: Kes 5,063.00

6. Mpawa Insurance Golfers’ Policy

- Key Benefits

- • Golfing Equipment (Single Article Limit: $15,000.00) -175,000.00

- • Personal Effects: $25,000.00

- • Hole in One: 20,000.00

- • Personal Accident

- Benefits applicable to Insured or Caddy for accidents and injuries occurring at the

- Golf Course)

- Death: 1,000,000.00

- Permanent Total Disability: $1,000,000.00

- Medical Expenses: $10,000.00

- Third Party Liability: $1,000,000.00

- Excess: Theft and damage Excess $1,000.00 Each and Every Loss (Applicable to

- (Equipment and Personal Effects)

- Annual Premium: Kes 5,469.00

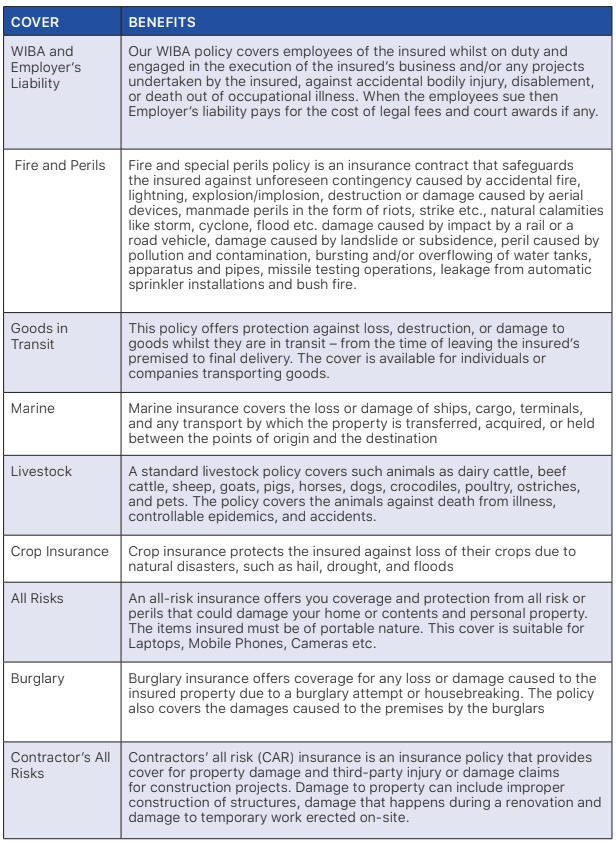

Other M-pawa Insurance Benefits

MPAWA INSURANCE FAQS

Does M-Pawa Insurance Agency offer a Last Expense cover?

Yes. Mpawa has a family Last Expense cover which currently covers 10 family members with a range of options available. The lowest option goes for an annual premium of Kes 3,300.00 per family per year.

If I want to ensure my motor vehicle with M-Pawa, what will I be required to produce?

Mandatory documents include copies of proposer’s ID, KRA Pin, Logbook, and an estimate of the vehicle’s value.premium of Kes 3,300.00 per family per year.

Which documents will I be required to produce when the vehicle is undergoing valuation?

You will be required to produce your ID, your KRA Pin and a copy of the vehicle’s logbook.

How do I register and access and use M-Pawa Service?

How to Register for M-Pawa Service

To register for Mpawa services: Visit your nearest Stima Sacco Branch and fill in the M-Pawa application form. When successfully registered, you will receive a start PIN on the registered mobile number?

How to activate M-pawa After Successful registration

3. Dial *489# and enter your start pin.

4. You will be prompted to change your PIN and confirm. The new PIN should be 6 digits.

5. When PIN is saved successfully you will be prompted to log in again to set up security questions.

6. Dial *489# and enter your new PIN.

7. Answer security questions asked (Kindly note the answers are case sensitive.